Last Updated on 06/25/2024 by Glynn Willard

Can You Claim The Home Office Deduction If You Live & Work In Your RV Full Time?

Full-time RVers often use a portion of their RV in which to work.

But is it a) realistic and b) feasible for RV owners to take a business deduction on the designated working space in their recreational vehicle?

Let’s explore the application of tax codes and RV tax deductions with the help of Penny Rose, CPA.

She is a certified public accountant, this is her expert niche, and she lives the full-time RV lifestyle.

So Penny is the perfect person to answer this question in detail.

The majority of the advice in this article is verbatim from Penny’s responses to my questions.

Slide into your mobile office and let’s get down to business!

Bottom Line: Can You Claim The Home Office Deduction In Your RV?

If you designate a portion of your RV (a dedicated office space) for exclusive and regular business use, you may use the Home Office Deduction.

Pay very close attention to the use of the word exclusive; meaning it cannot be used for any other purpose at any time, i.e., the kitchen counter is not an option.

Personal use of the work space negatively impacts eligibility for deductions.

If you look at designating a portion of your RV for exclusive and regular business use as an investment, then the tax savings from the home office deduction is the return on that investment.

Because RV square footage is so low, the resulting tax savings for the “home office space” is minimal.

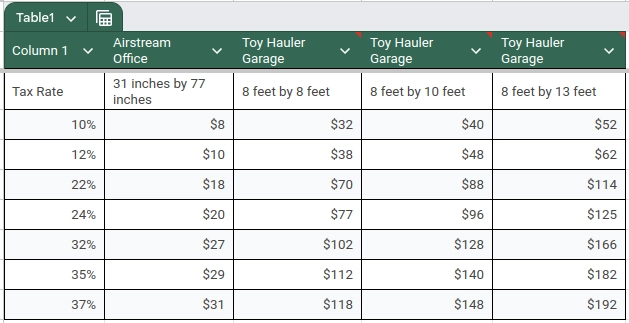

Review the following chart to see if the potential tax savings is worth exclusively using space inside your RV for your specific situation.

In the chart above, the largest reward is a $192 per year reduction in your tax bill, but that’s only if your taxable income is over $693,750 per year.

That certainly isn’t the majority of the RV population.

The 24% or 32% tax brackets are more realistic.

Is $125-166 per year saved in taxes worth never using your 8 foot by 13 foot toy hauler garage for any personal purpose?

Cue the “sad trombone!”

It means you won’t be using the garage to store your golf cart.

It also means no one will use it as a sleeping area if the beds drop from the ceiling.

And it means you cannot install your washer and dryer in your garage.

Seriously, these are small numbers when we’re discussing tax time deductions and may not be worth not using the space for anything personal.

IRS Tax Code To Qualify For A Home Office Deduction

The exception: 26 U.S. Code § 280A(c)(1)(A) provides an exception to the rule, 26 U.S. Code § 262(a), when part of your home is exclusively used on a regular basis as the principal place for business of the taxpayer.

The rule: 26 U.S. Code § 262(a) stipulates that no deduction shall be allowed for personal, living or family expenses.

Is Your RV For Business Purposes Or Personal Use?

If your RV usage is mixed between personal and business, keeping detailed records of days during which you worked more than four hours is critical supporting documentation.

This is especially a problem if your business involves allowing others to rent your RV.

If you rent out your RV, your personal usage cannot exceed 14 days per year.

Should a question ever arise, the IRS will ask you to provide documentation because their first thought will be that your RV usage is purely personal and therefore not a deductible expense.

In other words, you really do need documented proof.

Not Sure What You Need For Your RV?

Employed Or A Small Business Owner?

The home office deduction is only available to business owners or self-employed (sole proprietor) tax payers.

Prior to 2018, an employee who worked from home and itemized their deductions had the opportunity to use the unreimbursed employee expense deduction.

The unreimbursed expenses had to be more than 2% of the taxpayer’s adjusted gross income for the tax year.

All of this said, if you’re a small business owner with business income, living in an RV, there may be some business-related expenses associated with your RV that can be deducted.

Penny and I cover this in our article: Can RV Owners Expense Their RV As A Tax Business Deduction?

Is Your RV Your Primary Residence?

The home office deduction applies only to your primary residence.

Business owners and self-employed individuals cannot claim a home office deduction in two locations.

If you’re a part-time RVer, you cannot consider the home office deduction since the RV is your secondary home.

What If Your RV Is Your Second Home?

Once again, the home office deduction applies only to your primary residence.

This deduction can only be applied to your main home.

I’m really trying to drive this point home.

Is It A Good Idea To Take The Deduction If You Qualify?

Understand when it’s good to take a deduction.

It’s an urban legend that taking the home office deduction is a red flag on your tax return.

Each year, IRS publishes a list of the red flags.

It’s called the Dirty Dozen. You can find the Dirty Dozen from 2014 to 2023 here.

Maybe you stumbled on this article and only travel in your RV, but were concerned about claiming the home office deduction for your primary residence.

Penny just gave you the thumbs up to take the deduction if it’s worthwhile!

What’s The Best Type Of Tax Professional For Digital Nomads?

For digital nomads, finding a tax professional who specializes in serving their unique lifestyle and tax situations is crucial.

Many general tax preparers may not have deep expertise in the specific sections of the US tax code that apply to the mobile remote workforce.

The ideal tax professional for a digital nomad is one who either lives that nomadic lifestyle themselves or has extensive experience working with remote workers and taxpayers who travel frequently for business purposes across multiple states.

These specialists have a vested interest in thoroughly understanding the relevant provisions of the tax code pertaining to things like qualifying home office deductions, business travel expenses, non-resident state income taxes and much more.

The above criteria can get “hairy” when it comes to tax time!

Rather than a general tax preparer, digital nomads should seek out tax pros who have niche expertise in maximizing legal deductions and providing advice tailored specifically to their mobile circumstances.

Don’t settle for a tax professional who works with all types of clients – find one who caters to digital nomads and can ensure you remain fully compliant while taking advantage of all the RV tax benefits you’re entitled to.

Wrapping Up The Home Office Deduction If You Live In Your RV

Simply put, to qualify for the home office deduction in your “mobile home,” the following must apply:

- You must be a small business owner or self employed.

- The designated space for a home office cannot be used for personal reasons.

- The RV cannot be your secondary residence, i.e., it’s your only home.

- The deduction is generally very small because of the small space allotted by an RV, so the tax breaks may be moot.

- If you do qualify for the deduction and it is worth your while, it’s not a red flag.

As I mentioned earlier, this is not the first collaboration with Penny Rose.

She also contributed (a lot) to the article: Can RV Owners Expense Their RV As A Tax Business Deduction?

I want to personally thank Penny for taking the time to supply the bulk of the solutions in this article.

You can contact her directly through her website, Fefifofum Services.

She might just be the perfect fit for guiding your through the tax laws for your unique situation.

Are you ready for tax season if you RV full-time?

Meet the coauthor.

We appreciate any help in bringing you great content. Donate or buy us a coffee on our Ko-Fi site. Or subscribe to our YouTube Channel.

Thank you so much for being here!